Back Door Roth Ira Conversion Rules 2025 - In 2025, the contribution limits rise to $7,000, or $8,000 for those 50 and older. In 2010 congress changed the rules governing the conversion of a traditional ira to a roth ira.

In 2025, the contribution limits rise to $7,000, or $8,000 for those 50 and older.

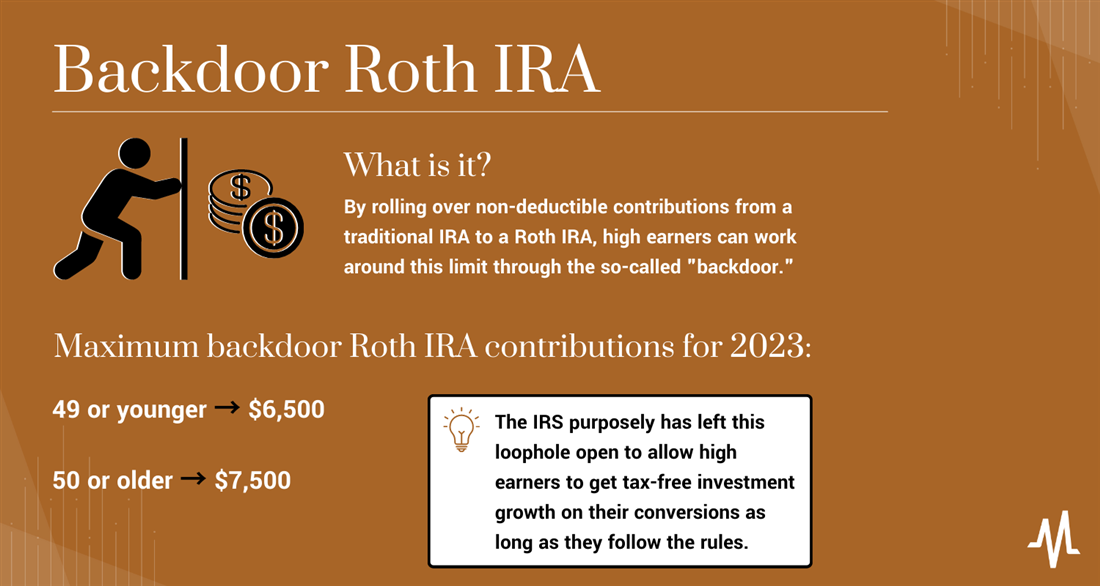

Backdoor Roth Rules 2025 Jenn Karlotta, A backdoor roth ira is a roth ira that is created when those who cannot. Between $138,000 and $153,000 for single filers and between.

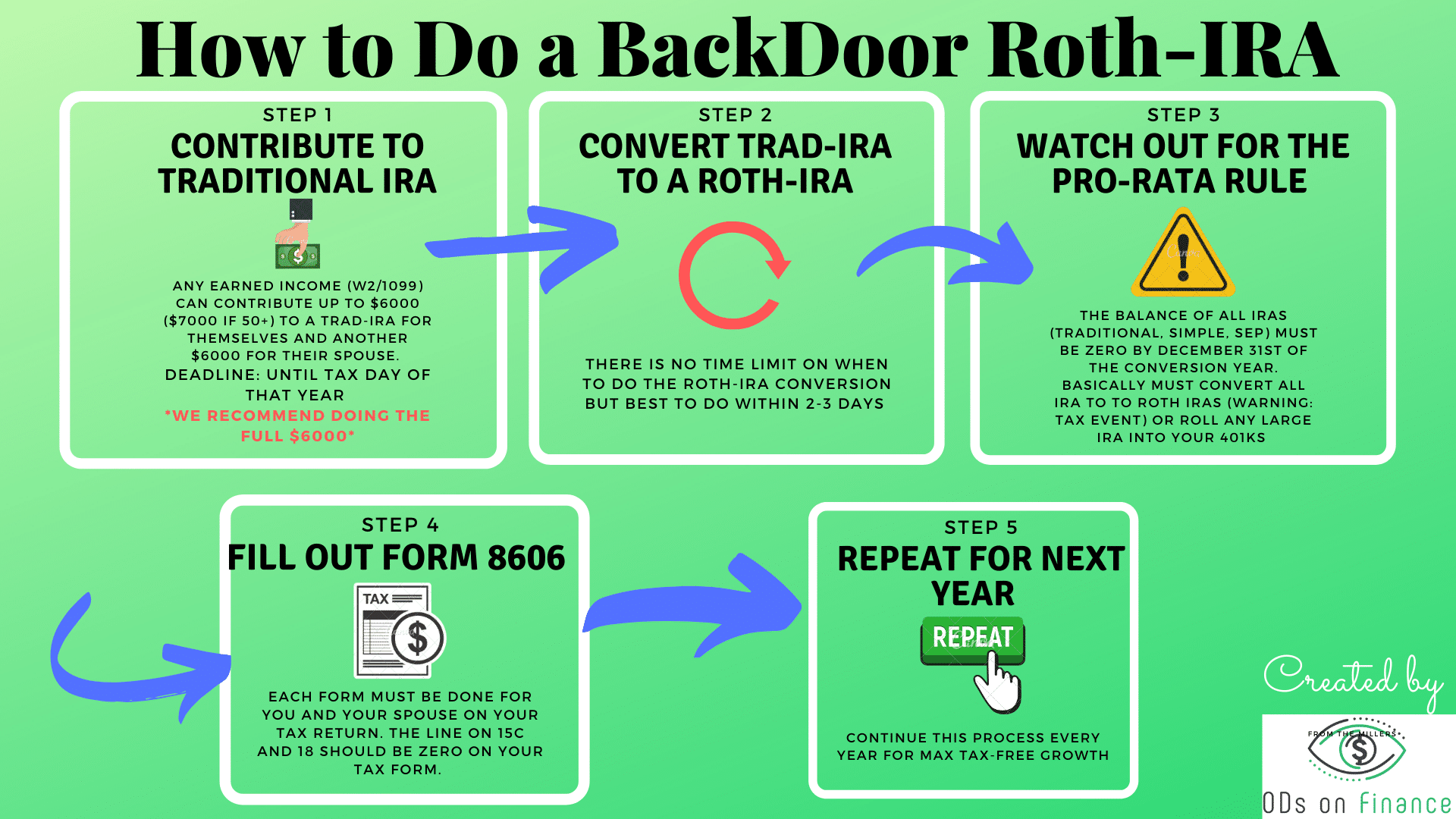

.png?width=940&name=Pro-Rata Rule Diagram Backdoor Roth Conversion (2).png)

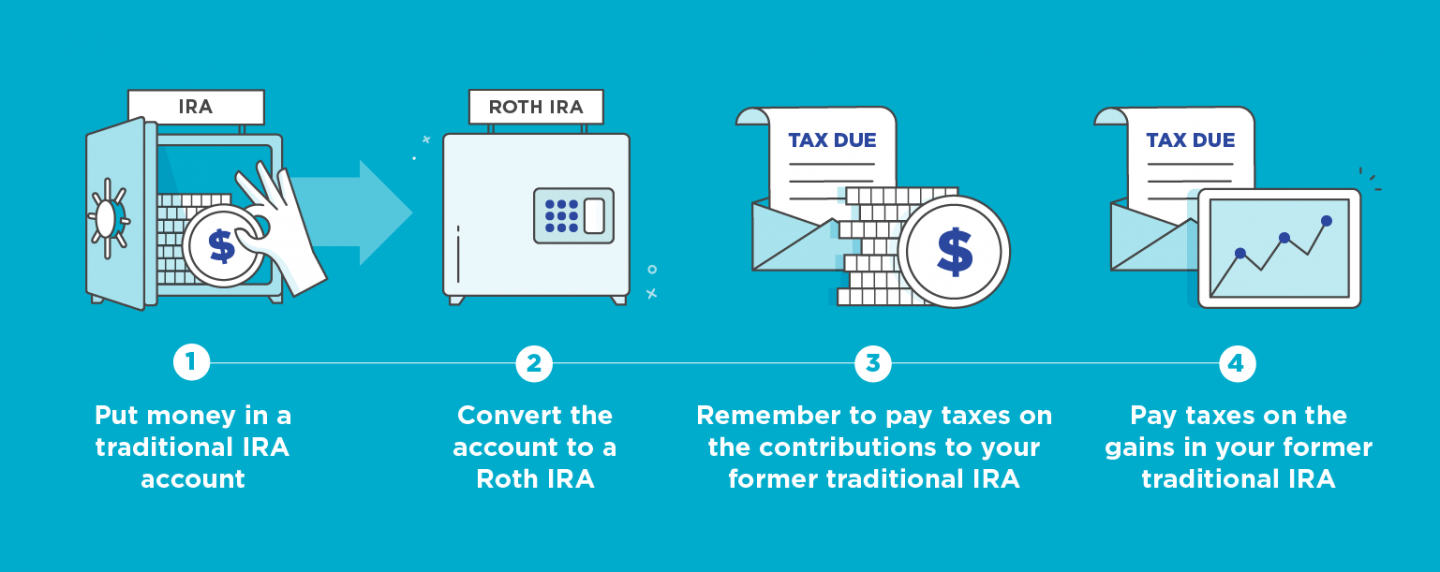

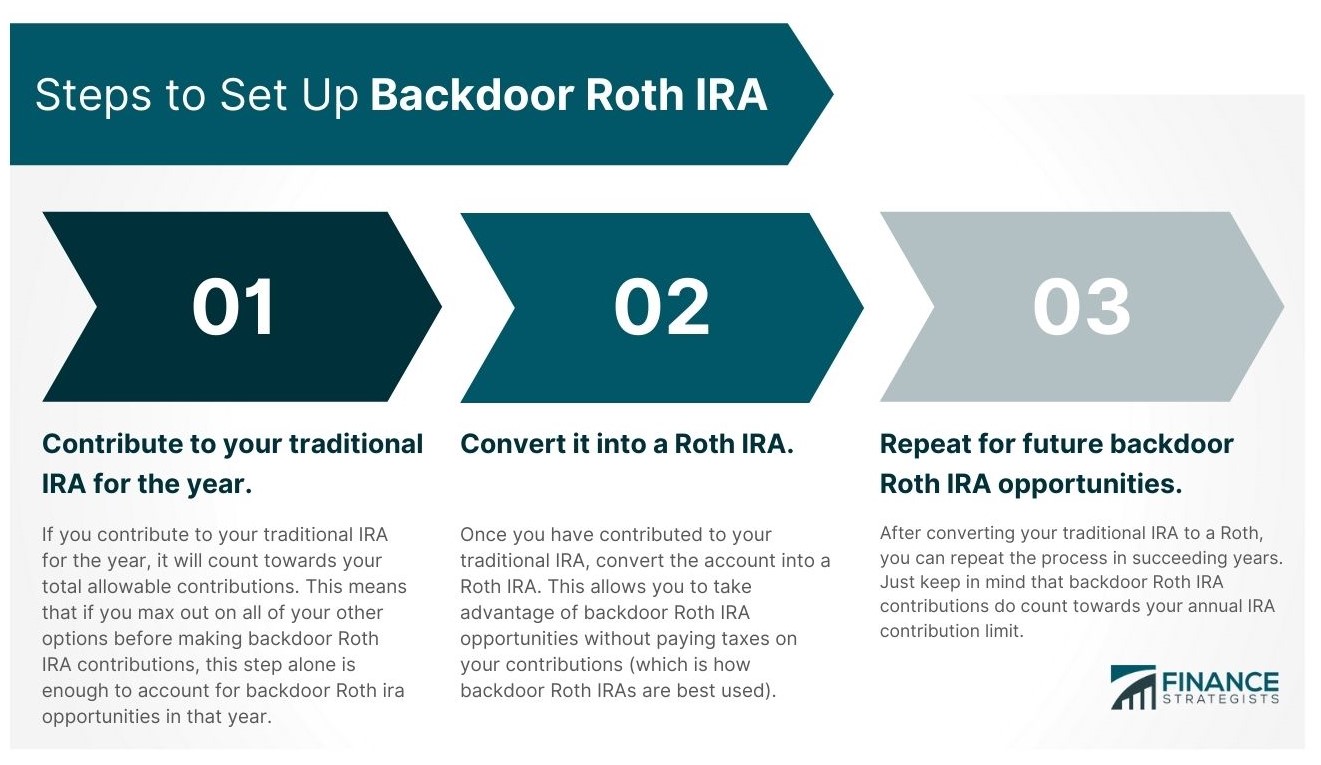

Backdoor Roth Rules 2025 Jenn Karlotta, Investors can convert a traditional ira into a roth ira using a backdoor roth. A backdoor roth ira is a roth ira that is created when those who cannot.

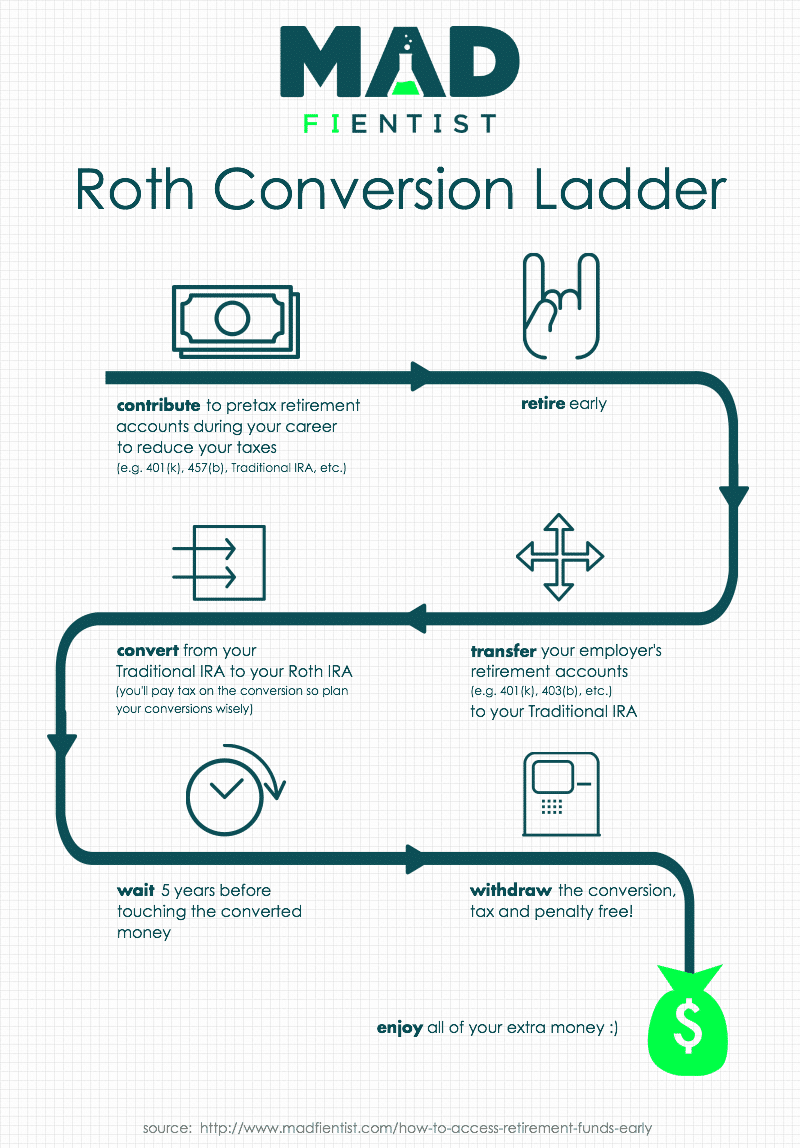

Backdoor Roth IRA Conversion and Strategy in 2025, This change eliminated the income restrictions and allowed all taxpayers,. Required minimum distributions, or rmds, are a problem for.

Roth IRAs, Between $138,000 and $153,000 for single filers and between. Put very simply, the mega backdoor roth strategy entails 2 steps:

:max_bytes(150000):strip_icc()/Mega-backdoor-roth-401-k-conversion-5210877_final-3e68d3495c174dc5a6d5f7fedd49d4cf.png)

Roth ira conversion rules for 2025, nevertheless, if you’re considering using a roth. This change eliminated the income restrictions and allowed all taxpayers,.

Backdoor Roth Rules 2025 Jenn Karlotta, What's a roth ira conversion? I like to get our backdoor roth contributions and conversions done early in the.

Backdoor Roth Ira Limits 2025 Jenn Karlotta, You’ll owe taxes on a. What's a roth ira conversion?

A backdoor roth ira is a conversion that allows high earners to open a roth.

Simple Back Door ROTH IRA Guide 2025 (TAX FREE FOR LIFE!) YouTube, The phaseout occurs between $146,000 and $161,000 for single filers and $230,000 and. A backdoor roth can be created by first contributing to a traditional ira and then immediately converting it to a roth ira to avoid paying taxes on any earnings or having earnings that.

Once your modified adjusted gross income (magi) tops.

Backdoor Roth Ira 2025 Darb Minnie, This change eliminated the income restrictions and allowed all taxpayers,. Nevertheless, if you're considering using a roth conversion or the backdoor roth as part of your retirement savings strategy, be sure to closely follow rules on conversions and speak with a tax advisor about the impact a conversion could have on your financial situation.

Backdoor Roth Ira 2025 Darb Minnie, Put very simply, the mega backdoor roth strategy entails 2 steps: Nevertheless, if you're considering using a roth conversion or the backdoor roth as part of your retirement savings strategy, be sure to closely follow rules on conversions and speak with a tax advisor about the impact a conversion could have on your financial situation.

Back Door Roth Ira Conversion Rules 2025. In 2025, the contribution limits rise to $7,000, or $8,000 for those 50 and older. I like to get our backdoor roth contributions and conversions done early in the.

Ira Backdoor 2025 Bren Marlie, You can convert all or part of the money in a traditional ira. I like to get our backdoor roth contributions and conversions done early in the.